Market rebounded today during Obama's state of union speech this morning. While Obama pledge to stabilize and grow the US economy is positive (I mean what else can he say), I think the crux of the whole speech is that he is NOT declaring war on the banks, and he just want to ensure that the US economy is sheltered from huge systematic risk.

After the strong populist rhetoric on whacking the US banks last week, today statement definitely sounds much milder and take some load off the negativity surrounding the uncertainty of what exactly his government intend to do to clamp down risk taking among banks.

Note that Davao economic forum is also on-going with most banking honcho denouncing any restriction on such clamping move and noted the limited effectiveness if it is not coordinated internationally (which is difficult if not impossible).

The market has an almost instantaneous effect when O Ma Ma took on a milder stance, as the market stage on a good TECHNICAL REBOUND.

Is the selling over? I think most of the selling is done (in fact over done). Margin call n force selling should end by today if any left...hence the market should stabilise from here.

Will the price go up? There will be technical rebound. Many Blue chip counters still have got some gaps to fill, but this could take time.

Will it go down again? I believe prices hereon will be volatile as the market seek out news for direction amid lack of fresh news.

Should I cut loss? If you din cut over the past few days, you are already a brave soul. As I said most force selling should be over. Price should stabilize from here, at least for the short while.

Should i buy to cover my loss? You buy to make money, not cover your loss! If you want to bargain hunt, you better be able to hold. At the same time, practise tight stop if the market move down again. In the mean time, look for good stock with fundamental. For the long run, I believe the forward PE ratio still looks good for Asia.

Can I buy US stock? Note that US market will stay in the doldrum and US banks will stay under pressure for awhile. Be prepare to sit out.

Commodity story is over? Personally I do not think so. Some correction is inevitable thou, but to start off with prices are not overly high to start off with (minus gold and silver lar!).

Is the coast clear? I dun know, but most negative news are already out. So at least for now...I think the heavy sea should be calmer....for now, I hope.

This commentary was send out to my client on Thursday morning during the state of union speech. Apologize for being late here.

This blog is a selections of my investment views to my client. If you find it useful or have additional information to share, please do let me know. These blogs are my personal views and is not meant to solicit any sales or investment on any securities or investment. I may have vested interest in some of the counters or investment products, hence please invest at your own risk. As usual invest in what you understand and do your own homework as usual.

Saturday, January 30, 2010

Wednesday, January 27, 2010

When will the bloodletting stop? Stock markets took another round of whacking

Equity market worldwide took a beating again today, as selling continue in the afternoon. News of Chinese banks being asked to pull back loan (yest the news is that they were asked to stop giving loan) give the shortists new ammunition to pound the market.

The recent selling is extraordinary and is almost brutal as prices plunge in quick succession. The price action seems to be indicating that big funds are pulling in a big way, and the shortist are definitely having a field day over the past 1 week.

Fundamentally, the selling is overdone. Everyone knew it, but at the same time, as long as the funds refuse to come in to buy up the market, the overall weakness will prevail. The freefall is exacerbated by margin call and contra players taking a hit in recent days. This will restrict further buying power for the days to come.

At this juncture, capital protection is a priority and all trade should come with a tight stop. If you are in the money do ensure you take them before they evaporate.

How far more will the market go? I frankly can't tell. Technically, the chart is oversold and a rebound should be in place. However, I am urging all my kaki to play on the cautious side and wait for Friday before considering going in.

Tonite is FOMC...which I do not expect anything new. Tomorrow Obama (should rename O Ma Ma) will be giving his state of union speech. I wonder what he will be saying this time round.

I am still putting my bet that this selling will not abate until O Ma Ma end his populist war of the banks stance...yes, personally I do think there is a conspiracy going on (yes you can laugh at me).

Coming back to my serious self, the charts attached are definitely looking ugly. Trend line and supports are pierced and the momentum definitely turning down. Is it the Bear market, i can hear you ask? I personally is still not putting my bet on it. Fundamentally, I do not see the world economy sinking into a new round of recession. Perhaps it got something to do with the White Tiger coming...this is a new theory, and I bet the remisers will be harping on this soon once they run out of reason to give their clients after days of selling.

Anyway, if you do hear that from your broker (or from me!), do know that all bad news has been absorbed and guess what....its shopping time again. As for now, stay out!

This blog is a selections of my investment views to my client. If you find it useful or have additional information to share, please do let me know. These blogs are my personal views and is not meant to solicit any sales or investment on any securities or investment. I may have vested interest in some of the counters or investment products, hence please invest at your own risk. As usual invest in what you understand and do your own homework as usual.

The recent selling is extraordinary and is almost brutal as prices plunge in quick succession. The price action seems to be indicating that big funds are pulling in a big way, and the shortist are definitely having a field day over the past 1 week.

Fundamentally, the selling is overdone. Everyone knew it, but at the same time, as long as the funds refuse to come in to buy up the market, the overall weakness will prevail. The freefall is exacerbated by margin call and contra players taking a hit in recent days. This will restrict further buying power for the days to come.

At this juncture, capital protection is a priority and all trade should come with a tight stop. If you are in the money do ensure you take them before they evaporate.

How far more will the market go? I frankly can't tell. Technically, the chart is oversold and a rebound should be in place. However, I am urging all my kaki to play on the cautious side and wait for Friday before considering going in.

Tonite is FOMC...which I do not expect anything new. Tomorrow Obama (should rename O Ma Ma) will be giving his state of union speech. I wonder what he will be saying this time round.

I am still putting my bet that this selling will not abate until O Ma Ma end his populist war of the banks stance...yes, personally I do think there is a conspiracy going on (yes you can laugh at me).

Coming back to my serious self, the charts attached are definitely looking ugly. Trend line and supports are pierced and the momentum definitely turning down. Is it the Bear market, i can hear you ask? I personally is still not putting my bet on it. Fundamentally, I do not see the world economy sinking into a new round of recession. Perhaps it got something to do with the White Tiger coming...this is a new theory, and I bet the remisers will be harping on this soon once they run out of reason to give their clients after days of selling.

Anyway, if you do hear that from your broker (or from me!), do know that all bad news has been absorbed and guess what....its shopping time again. As for now, stay out!

This blog is a selections of my investment views to my client. If you find it useful or have additional information to share, please do let me know. These blogs are my personal views and is not meant to solicit any sales or investment on any securities or investment. I may have vested interest in some of the counters or investment products, hence please invest at your own risk. As usual invest in what you understand and do your own homework as usual.

Keppel Corp - New green trust listing. Solid dividend.

Keppel Corp's profit up 15% on-year, plans to list "green" trust (Source Channel news asia)

Conglomerate Keppel Corp on Tuesday posted record profits for 2009, but warned that surpassing the performance will be a challenge this year.

Keppel is also planning to list a business trust in the second quarter, focusing on eco-friendly infrastructure.

The oil rig business was good for Keppel Corp in 2009 as improved margins from rig orders boosted its offshore and marine division, which contributes about two-thirds of the group's profits. Strong earnings from its property unit also helped.

Keppel's net profit for 2009 jumped 15 per cent on-year to a new record of S$1.26 billion. But revenue rose a modest four per cent to S$12.2 billion.

In the quarter ended December, Keppel earned S$343 million on revenues of S$3.03 billion. The fourth-quarter numbers exclude an exceptional gain of S$322 million from selling its stake in Singapore Petroleum Corp.

"This is the best year ever," said Choo Chiau Beng, chief executive officer at Keppel Corp. "While we are working very hard to make sure that we (grow the) ... business and so on, I think it will be tough to beat this result."

To spur growth ahead, Keppel plans to list a business trust in Singapore, which will focus on green infrastructure.

Choo said: "We think there's a lot of need for new green projects, and we will actively participate in that and we see that the trust will give us an avenue to do that in a more efficient way.

"We are optimistic about the environmental business. Because sustainable environment is something that human beings and governments have to invest and have to spend money on, so we are on this trend."

Keppel Corp said that for now, the aim of the green trust is not to raise money, but to reward its investors.

It will distribute 50.5 per cent of K-Green Trust to shareholders by giving them one unit for every five shares held. Keppel Integrated Engineering will keep the rest. This means a distribution value of 23 cents per share.

This will be part of a proposed dividend of 61 cent, which the company is proposing to offer shareholders. There will be a final cash dividend of 23 cents per share, on top of the interim cash dividend of 15 cents per share, paid earlier this year.

The green trust's initial assets will comprise two Singapore waste-to-energy incineration plants and a distilled water complex.

My Take:

Keppel Corp was being pushed down with the rest of the crowd yest to hit a 20 days low of 8.08. This morning it gap up to open at 8.20 on the back of the solid 2009 result and news of its listing of a green trust.

The final dividend in my view is very attractive: 23 cents cash and another 20 cents in form of share = 43 cents, this is taking out the interim cash dividend of 15cents which has been paid.

Technically, yesterday Kepcorp is oversold, and today it may attempt to fill the gap between 8.28 and 8.35 that was caused by the drop on Friday. 8.31 seems to be the immediate resistance, with immediate support at yest low of 8.08.

This blog is a selections of my investment views to my client. If you find it useful or have additional information to share, please do let me know. These blogs are my personal views and is not meant to solicit any sales or investment on any securities or investment. I may have vested interest in some of the counters or investment products, hence please invest at your own risk. As usual invest in what you understand and do your own homework as usual.

| ||||||

| ||||||

Conglomerate Keppel Corp on Tuesday posted record profits for 2009, but warned that surpassing the performance will be a challenge this year.

Keppel is also planning to list a business trust in the second quarter, focusing on eco-friendly infrastructure.

The oil rig business was good for Keppel Corp in 2009 as improved margins from rig orders boosted its offshore and marine division, which contributes about two-thirds of the group's profits. Strong earnings from its property unit also helped.

Keppel's net profit for 2009 jumped 15 per cent on-year to a new record of S$1.26 billion. But revenue rose a modest four per cent to S$12.2 billion.

In the quarter ended December, Keppel earned S$343 million on revenues of S$3.03 billion. The fourth-quarter numbers exclude an exceptional gain of S$322 million from selling its stake in Singapore Petroleum Corp.

"This is the best year ever," said Choo Chiau Beng, chief executive officer at Keppel Corp. "While we are working very hard to make sure that we (grow the) ... business and so on, I think it will be tough to beat this result."

To spur growth ahead, Keppel plans to list a business trust in Singapore, which will focus on green infrastructure.

Choo said: "We think there's a lot of need for new green projects, and we will actively participate in that and we see that the trust will give us an avenue to do that in a more efficient way.

"We are optimistic about the environmental business. Because sustainable environment is something that human beings and governments have to invest and have to spend money on, so we are on this trend."

Keppel Corp said that for now, the aim of the green trust is not to raise money, but to reward its investors.

It will distribute 50.5 per cent of K-Green Trust to shareholders by giving them one unit for every five shares held. Keppel Integrated Engineering will keep the rest. This means a distribution value of 23 cents per share.

This will be part of a proposed dividend of 61 cent, which the company is proposing to offer shareholders. There will be a final cash dividend of 23 cents per share, on top of the interim cash dividend of 15 cents per share, paid earlier this year.

The green trust's initial assets will comprise two Singapore waste-to-energy incineration plants and a distilled water complex.

My Take:

Keppel Corp was being pushed down with the rest of the crowd yest to hit a 20 days low of 8.08. This morning it gap up to open at 8.20 on the back of the solid 2009 result and news of its listing of a green trust.

The final dividend in my view is very attractive: 23 cents cash and another 20 cents in form of share = 43 cents, this is taking out the interim cash dividend of 15cents which has been paid.

Technically, yesterday Kepcorp is oversold, and today it may attempt to fill the gap between 8.28 and 8.35 that was caused by the drop on Friday. 8.31 seems to be the immediate resistance, with immediate support at yest low of 8.08.

This blog is a selections of my investment views to my client. If you find it useful or have additional information to share, please do let me know. These blogs are my personal views and is not meant to solicit any sales or investment on any securities or investment. I may have vested interest in some of the counters or investment products, hence please invest at your own risk. As usual invest in what you understand and do your own homework as usual.

Sunday, January 24, 2010

Obama declared war on Wall Street? Or is it just the same old story?

By now most of you should have read somewhere about President Obama's proposal to rein in risk taking by banks. If you have not, you should at least know that there was a bloodbath on stock market (and yes commodity also) around the world over the past few days. If you still have not, well count yourself blessed.

In any case, I am writing this just to give some basic understanding on what President Obama is actually proposing that had rattle Wall Street and the rest of the financial world of late.

While he has been vague on details, I believe that what ultimately Obama is proposing is similar, if not the same, with what the US has implemented in 1933 called the Glass Steagall Act (GSA).

So what is the Glass Steagall Act?

In a nutshell:

Historical Background:

The Act came about in 1933, after the collapse of the US stock market which caused the great Depression in 1929, and is largely designed to prevent commercial banks from taking on risky asset largely via investment banking activities.

Basically, the act separate the commercial banking entity from its investment banking entity.

Rationale:

Through separation of the entities, the act technically prevented commercial deposit which is being collected on a low risk basis from being channeled into high risk investment area thus stemming the likelihood of the government coming in to bailout and prevent the collapse of commercial deposit in the event of a huge investment failure by the banks (To some extent this define what it mean by too big to fail).

Why was it repeal in 1999?

The GSA is repealed in 1999, as it was deemed as too harsh and have a mixed bag of effects on the US financial sectors.

"The limitations of the GSA on the banking sector sparked a debate over how much restriction is healthy for the industry. Many argued that allowing banks to diversify in moderation offers the banking industry the potential to reduce risk, so the restrictions of the GSA could have actually had an adverse effect, making the banking industry riskier rather than safer. Furthermore, big banks of the post-Enron market are likely to be more transparent, lessening the possibility of assuming too much risk or masking unsound investment decisions. As such, reputation has come to mean everything in today's market, and that could be enough to motivate banks to regulate themselves." Investopedia

What is the impact on the financial market going forward?

While the reform is seen as highly restrictive and will most likely affect the trading volume in most financial market and the profitability of US banks, its direct impact will not be known until we can get a clearer picture on the details.

What is most worrying is the timing of the proposal which will shroud the market under a cloud of uncertainty all the way through to the US mid-term elections, which is scheduled only in November 2010.

In my personal perspective, this proposal is seen as a declaration of war on Wall Street and is likely to create much volatility and likely persistent weakness in the stock market for the near term. This is clearly evidence at the bloodbath seen over the past few days, which saw funds pulling out the market in a big way.

Frankly, I am not sure which one is better: A weak stock market with a stronger banking sector or a strong stock market with a weaker banking sector. With already a healthcare reform on his shoulder, I am not sure how much President Obama can stomach seeing a recovering market back on its knee....

I have attached here the charts for DJIA, HS and STI.

DJIA has pierced through my expected support around the 10,200 region. I fear more downside here.

HS is near the support line around 20,200 region. I am looking for some momentum rebound (hopefully). Otherwise HS may go further down to 19,500 region.

STI seems to imitate HS by sitting near its support line. I am also looking for some momentum rebound. 2,700 region is still the key support region if this pierce down.

In any case, in such volatile market, always play safe and stay nimble.

God Bless!

This blog is a selections of my investment views to my client. If you find it useful or have additional information to share, please do let me know. These blogs are my personal views and is not meant to solicit any sales or investment on any securities or investment. I may have vested interest in some of the counters or investment products, hence please invest at your own risk. As usual invest in what you understand and do your own homework as usual.

In any case, I am writing this just to give some basic understanding on what President Obama is actually proposing that had rattle Wall Street and the rest of the financial world of late.

While he has been vague on details, I believe that what ultimately Obama is proposing is similar, if not the same, with what the US has implemented in 1933 called the Glass Steagall Act (GSA).

So what is the Glass Steagall Act?

In a nutshell:

Historical Background:

The Act came about in 1933, after the collapse of the US stock market which caused the great Depression in 1929, and is largely designed to prevent commercial banks from taking on risky asset largely via investment banking activities.

Basically, the act separate the commercial banking entity from its investment banking entity.

Rationale:

Through separation of the entities, the act technically prevented commercial deposit which is being collected on a low risk basis from being channeled into high risk investment area thus stemming the likelihood of the government coming in to bailout and prevent the collapse of commercial deposit in the event of a huge investment failure by the banks (To some extent this define what it mean by too big to fail).

Why was it repeal in 1999?

The GSA is repealed in 1999, as it was deemed as too harsh and have a mixed bag of effects on the US financial sectors.

"The limitations of the GSA on the banking sector sparked a debate over how much restriction is healthy for the industry. Many argued that allowing banks to diversify in moderation offers the banking industry the potential to reduce risk, so the restrictions of the GSA could have actually had an adverse effect, making the banking industry riskier rather than safer. Furthermore, big banks of the post-Enron market are likely to be more transparent, lessening the possibility of assuming too much risk or masking unsound investment decisions. As such, reputation has come to mean everything in today's market, and that could be enough to motivate banks to regulate themselves." Investopedia

What is the impact on the financial market going forward?

While the reform is seen as highly restrictive and will most likely affect the trading volume in most financial market and the profitability of US banks, its direct impact will not be known until we can get a clearer picture on the details.

What is most worrying is the timing of the proposal which will shroud the market under a cloud of uncertainty all the way through to the US mid-term elections, which is scheduled only in November 2010.

In my personal perspective, this proposal is seen as a declaration of war on Wall Street and is likely to create much volatility and likely persistent weakness in the stock market for the near term. This is clearly evidence at the bloodbath seen over the past few days, which saw funds pulling out the market in a big way.

Frankly, I am not sure which one is better: A weak stock market with a stronger banking sector or a strong stock market with a weaker banking sector. With already a healthcare reform on his shoulder, I am not sure how much President Obama can stomach seeing a recovering market back on its knee....

I have attached here the charts for DJIA, HS and STI.

DJIA has pierced through my expected support around the 10,200 region. I fear more downside here.

HS is near the support line around 20,200 region. I am looking for some momentum rebound (hopefully). Otherwise HS may go further down to 19,500 region.

STI seems to imitate HS by sitting near its support line. I am also looking for some momentum rebound. 2,700 region is still the key support region if this pierce down.

In any case, in such volatile market, always play safe and stay nimble.

God Bless!

This blog is a selections of my investment views to my client. If you find it useful or have additional information to share, please do let me know. These blogs are my personal views and is not meant to solicit any sales or investment on any securities or investment. I may have vested interest in some of the counters or investment products, hence please invest at your own risk. As usual invest in what you understand and do your own homework as usual.

Friday, January 15, 2010

Is the market losing steam?

After a good new year run, I am asking myself whether the market is losing steam after seeing the lackluster trade this morning. Trading volume has certainly creeped down and market movement has been relatively tame despite DJ performing respectably over the past few days.

China tightening move may have dampened the spirit and capped further upside, but as I have argued earlier, I do not see this as a fundamentally flaw policy and in fact think its for the better going forward.

The question however at this juncture is where is the market heading next - and from the way it look....maybe nowhere.

Is the market going to rally further? I doubt so. The expectation of a better 4Q has more or less been factored in. If any upside, it should be limited.

Is the market going to tank? I doubt so too. No reason for it to tank. If any, it will be some profit taking action.

Turning to the chart for some clue...I notice something.....Did u see what I see?

It seems to me that the indexes may have flattened lately from its uptrend (yes it is still technically on uptrend) and is entering into a sideway trading phase, or technically a time correction phase. This I believe is reasonably sound considering the arguement above that any pricing correction should be limited.

Keeping this in mind, I believe we have entered into a sideway trading phase until the market find new momentum and reason to see the breakout it required. Hence for now...may be buy near the support and sell near the resistance is the only option.

DJIA 10900 - 10200

HS 20285 - 23115

STI 2700 - 2960

Maybe its just my sentiment today...hopefully.

God Bless!

This blog is a selections of my investment views to my client. If you find it useful or have additional information to share, please do let me know. These blogs are my personal views and is not meant to solicit any sales or investment on any securities or investment. I may have vested interest in some of the counters or investment products, hence please invest at your own risk. As usual invest in what you understand and do your own homework as usual.

China tightening move may have dampened the spirit and capped further upside, but as I have argued earlier, I do not see this as a fundamentally flaw policy and in fact think its for the better going forward.

The question however at this juncture is where is the market heading next - and from the way it look....maybe nowhere.

Is the market going to rally further? I doubt so. The expectation of a better 4Q has more or less been factored in. If any upside, it should be limited.

Is the market going to tank? I doubt so too. No reason for it to tank. If any, it will be some profit taking action.

Turning to the chart for some clue...I notice something.....Did u see what I see?

It seems to me that the indexes may have flattened lately from its uptrend (yes it is still technically on uptrend) and is entering into a sideway trading phase, or technically a time correction phase. This I believe is reasonably sound considering the arguement above that any pricing correction should be limited.

Keeping this in mind, I believe we have entered into a sideway trading phase until the market find new momentum and reason to see the breakout it required. Hence for now...may be buy near the support and sell near the resistance is the only option.

DJIA 10900 - 10200

HS 20285 - 23115

STI 2700 - 2960

Maybe its just my sentiment today...hopefully.

God Bless!

This blog is a selections of my investment views to my client. If you find it useful or have additional information to share, please do let me know. These blogs are my personal views and is not meant to solicit any sales or investment on any securities or investment. I may have vested interest in some of the counters or investment products, hence please invest at your own risk. As usual invest in what you understand and do your own homework as usual.

Thursday, January 14, 2010

PBOC Tightening - Fundamentally Positive

Stocks hit a Chinese wall Last evening, the People’s Bank of China (PBOC) announced it will raise the reserve ratio requirement (RRR) by 50 bps to 16% from 15.5% for big banks and to 14% from 13.5% for smaller institutions from Jan 18 with rural credit cooperatives excluded.That took the wind out of the sails of Asian markets. This is the first time since Dec 08 (after the Lehman collapse) that the PBOC is raising the ratio. Analysts and economists were expecting the RRR to be raised sometime in February. According to Bloomberg News, a median of 11 forecasts were expecting the move to be made only in April. As a result, the Hang Seng Index lost 578 points or 2.6% to close at 21,748 on Wednesday while the Shanghai Composite Index dived 3.1% or 101 points to close at 3,172. In a research note, DBS Research says that the China’s decision to hike its RRR “sends the clearest signal yet that it is beginning to tighten monetary policy”. That in turn could dampen sentiment for stocks with pure exposure to Chinese properties, it adds. Chinese property companies listed on the Singapore Exchange include Chongqing-based Ying Li International Real Estate, Yanlord Land Group, Centraland, Pan Hong Property Group, Guangdong-based China Yuanbang Property Holdingsand Sunshine Holdings. Analysts also predicted that any tightening of monetary policy by PBOC will affect commodities. Already, copper and oil eased on Wednesday, while the Baltic Dry Index ended at 3,160, down roughly a third from its Nov 09 high of 4,661. STX Pan Ocean lost 56 cents to $15.50 on Wednesday. Other SGX bulk carrier operators include Mercator Lines and Courage Marine. DBS Research believes there could be “a knee-jerk reaction from commodity plays such as CPO (crude palm oil) and coal”. Wilmar Internationalhas been very much a China play and its stratospheric ascent came to an abrupt halt on Wednesday when prices fell 13 cents to $7.04. “We note that CPO stocks Indofood-Agri Resources (target price: $2.30) and First Resources (target price: $1.16) have both exceed our fundamental target prices,” DBS says. On the other hand, Citigroup Research reckons any tightening by PBOC would have a positive impact on Chinese banks. “We see the sector range-bound in the near term due to capital raising uncertainties, but view monetary tightening as fundamentally positive leading to higher net interest margins (NIM),” Citigroup says in a report released on Wednesday. “We would much prefer slower loan growth and higher NIMs than the opposite combination.” Its top picks are China Construction Bank, China Merchants Bankand China Citic Bank. While the 0.5 percentage point increase in bank reserve requirement only drains about RMB200-300 billion ($40.7–$61.1 billion) from the market, it could be the start of further tightening which could drain another RMB500 billion from the market, China watchers estimate. Moreover, this first step comes in the wake of the Chinese government’s concerns over inflation. Bank lending is estimated to have risen to RMB600 billion in the first week of January versus RMB295 billion in Nov ’09. Asian markets could be vulnerable should PBOC tighten further, analysts warn. Chart Watch: Short-term decline The STI’s decline was more measured than its North Asian peers with the index falling 27.7 points to 2,888. Support for the decline is at 2,800, and the still rising 50-day moving average is at 2,795. Last Friday, short-term indicators had turned down. Monday’s move to a new high of 2,933 created a minor negative divergence. This is not a major divergence, and a failure swing hasn’t materialised. Against this background, the down move should be temporary as the main uptrend remains intact. — Goola Warden, The Edge | ||

| Disclaimer: The Edge Publishing Pte Ltd does not accept any liability whatsoever for any direct, indirect or consequential losses or damages that may arise from the use of information or opinions in this newsletter. The information and opinions are not to be considered as an offer to buy or sell any of the companies discussed. If you do not wish to receive any further emails, please clickhere.For other inquiries, please contact The Edge Publishing Pte Ltd, 150 Cecil Street # 13-00, Singapore 069543. Phone: (65) 6232 8622 Fax : (65) 6232 8630. * terms and conditions apply Email: edge-sgonline@bizedge.com | ||

My Take:

Fundamentally, PBOC tighthening is an important move to restraint the run away loan growth as well as asset price. This is in fact an important step by the chinese government to rein in, or to at least signal to the market that they are not keen to see unfettered growth in asset price and hot money flow.

While this may be negative for Property and Chinese bank stocks in the near term, in the long run, this move should be viewed as healthy.

As for commodity, it is time for some healthy revaluing anyway. Physically, I do not think demand for commodity will come down. I will let the hype die down a tad, and look for good re-entry opportunity. Wilmar, Noble, Olam - blue chip commodity play in SGX. Can also look at H-share for more upside.

This blog is a selections of my investment views to my client. If you find it useful or have additional information to share, please do let me know. These blogs are my personal views and is not meant to solicit any sales or investment on any securities or investment. I may have vested interest in some of the counters or investment products, hence please invest at your own risk. As usual invest in what you understand and do your own homework as usual.

Monday, January 11, 2010

Goldman Sachs report show Asia equity may not be overbought

| GOLDMAN SACHS: China 'overweight', investors 'quite positive' |  |  |

| Written by Andrew Vanburen (China Correspondent) Nextinsight | |

| Sunday, 10 January 2010 | |

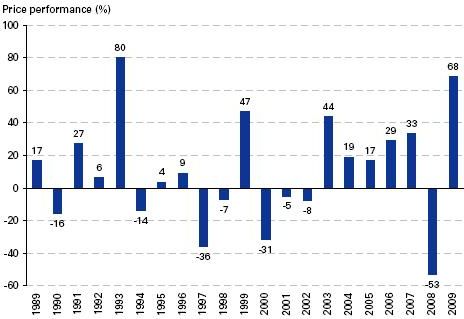

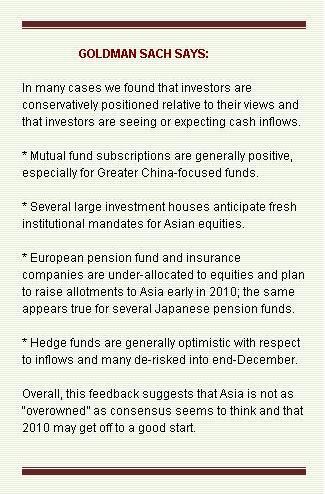

2009 was the second best year ever for Asian markets .... after the worst year 2008. Above: MSCI all country Asia Pacific ex Japan (USD) index. CHINA GETS another “overweight” call from Goldman Sachs for 2010 after the brokerage held over 150 investor meetings in Hong Kong, Europe and the US, and found investors to be “generally positive” on stock market return prospects for the year in Asian region. The brokerage said it expects 34% usd total returns for Asia this year, propelled primarily by above-consensus earnings growth on improving margins. “We are overweight China, Taiwan and Korea, and favor tech and consumption/infrastructure sectors. The unifying theme for our market and sector views is under-recognized (and under-priced) growth: China and Taiwan are changing their growth drivers, and tech earnings could be well ahead of consensus,” Goldman said. It said it expects markets in the region to get off to a good start this year as investors “re-risk." “In terms of sectors, we think tech has the most upside, and continue to broadly favor domestic demand/infrastructure themes like Chinese steel.” Goldman Sachs said that its over 150 investor meetings allows it to be “surprisingly positive on Asian markets for 2010, notwithstanding an initial skeptical bias.” The brokerage cited several reasons why it believes margins in the region will outperform consensus estimates. “The reasons for this are that a) capacity utilization in Asia is higher than many think which implies more positive operating leverage than consensus expects, and b) there is a rapid adaptive shift in Asian earnings towards EM, which means Asian companies benefit from the 8+% GDP growth in the emerging world and are less hampered by the 2% growth in the developed world.” It pointed to South Korea as a major beneficiary of the rise of the BRICs (Brazil, Russia, India and China) and the enhanced external demand from these four countries. “For example, Korea now exports more tech products to the BRICs than it does to the G3, whereas six years ago Korea was selling 5X more to the G3 than the BRICs. This is a staggering adjustment in such a short period.”  Steel demand from shipbuilders like Singapore-listed Yangzijiang is helping Goldman Sachs favor Chinese steel firms. Photo: Romil Singh Investors ‘quite positive’ Goldman Sachs said that reception among investors to its strong 2010 equity return expectations has been “quite positive.” “Not everyone agrees with everything we are saying – and we would not expect or want this to be the case – but we encountered little vigorous pushback or criticism of our logic.” Goldman said that in several instances it found that investors were “conservatively positioned” relative to their views and that investors are seeing or expecting cash inflows. “Mutual fund subscriptions are generally positive, especially for Greater China-focused funds.” It said many big investment houses expected “fresh institutional mandates” for equities in Asia. “European pension fund and insurance companies are under-allocated to equities and many plan to raise allotments to Asia early in 2010; the same appears true for several Japanese pension funds. Hedge funds are generally optimistic with respect to inflows and many de-risked into end-December. “Overall, this feedback suggests that Asia is not as “over-owned” as consensus seems to think and that 2010 may get off to a good start.”  Goldman Sachs obtained feedback from over 150 investor meetings in Asia, Europe and US. The grass is always greener… Goldman Sachs said that it found the least bullish sentiment among various investors regarding the markets in which they operate. “Interestingly, we encountered the greatest resistance to our Korea upgrade from domestic investors in Seoul. We also found more skepticism of our positive China equity views with domestic China accounts than we did with regional investors in Hong Kong, Europe or the US.” The brokerage also noted a “conservative” sentiment driving most investors, suggesting that the demons of 2008 and much of last year’s economic performance were not fully exorcised, and investors’ most-mentioned downside risks for equity return performance in Asian markets gravitated around these threats. “The risks that investors most frequently mentioned were a) China inflation and the threat of a sharp policy response (lots of concerns about a mid-year spike); and b) a stronger US dollar and the concern that this could impair Asian equity performance.” Goldman said that regarding investors anxieties over the possibility of a stronger greenback, it had the following point. “The inverse correlation over the past two years between the broad dollar index and the Asian equity index does not prove that a rising or falling dollar caused Asian stocks to move in an opposing direction. “In our view, both assets were responding to the same underlying fundamental drivers, notably the credit crisis and severe economic downturn that sparked a bear market in equities and a flight to liquidity and safety.” Goldman said that expectations that Asia growth model would fully “de-couple” from external demand (primarily the US) are premature, and there was always an upside to be factored in when the US dollar appreciated, as it spurred Asian exports to its traditional “best customer.” “Looking forward, if the dollar strengthens because the US economy is stabilizing, this would be positive for global growth and for Asian markets. The relative performance of Asia vs. US equities might be affected by a stronger dollar, but we would still expect very good absolute returns for regional stocks.” My Take: The Goldman report did not surprise me as I have also been arguing for the surprise on the upside for the equity market. Anecdotal evidence from my talking to clients and investors also indicate that many are still cautious on the equities market, citing the huge 60-70% jump from last march...which mean that quite a fair bit are still not full vested in the stock market. 4Q09 and 1Q10 results may surprise on the upside as I had argued earlier as inventory replenishment and demand from outside US seems to be stabilizing if not improving. This may fuel the stock market higher in the next couple of months. Keeping the above in mind, and the fact that funds are also not fully vested in equities, this will mean that the stock market may not be over bought after all, and the risk of a 10% to 20% technical correction (which some are waiting for), may not happen anytime soon! If that is the case, this may means that buying interest especially from the funds that has been waiting on the sideline, may decide to come in sooner rather than later, afraid that they may missed out the rally bandwagon. Regarding the risk in China, I seriously doubt the Chinese government will be stupid enough to kill off their growth. With recent export number being positive, this may give the chinese government some leeway in revaluing the RMB and thus reining in inflation. As in all healthy market, correction after extended rally is always expected, but I believe such correction will be of limited scale in the near term. |

This blog is a selections of my investment views to my client. If you find it useful or have additional information to share, please do let me know. These blogs are my personal views and is not meant to solicit any sales or investment on any securities or investment. I may have vested interest in some of the counters or investment products, hence please invest at your own risk. As usual invest in what you understand and do your own homework as usual.

Friday, January 8, 2010

US payrolls could confirm recovery. Growth in Asia and Europe to support recent rally.

| Tonight key number from US. I have attached the article here for your reading pleasure. | |

| Economic Outlook Payrolls could see first gain since 2007

| |

In any case, while attention is still focus on the US market, the truth is that economy in Asia and now Europe could be on a speedier rebound than expected. While some are still skeptical on the economic rebound based on the fact that the US is still the largest consumption market in the world, I believe that 4Q09 and 1Q10 results should be positive and would continue to provide the underlying support for the recent market rally.

There will definitely be some market correction after the recent gain, but any such correction is likely to be limited and should be seen as opportunity for market entry.

So yes, I am still bullish on the market...for those who has been asking me.

This are my personal opinion.

This blog is a selections of my investment views to my client. If you find it useful or have additional information to share, please do let me know. These blogs are my personal views and is not meant to solicit any sales or investment on any securities or investment. I may have vested interest in some of the counters or investment products, hence please invest at your own risk. As usual invest in what you understand and do your own homework as usual.

Thursday, January 7, 2010

Epure - another dual listing news. S-chip worth revisiting.

Epure share price shot up to 90cents this morning (now trading at 88cents, up 5.5cents from yest close) on news of its dual listing in Hong Kong.

This is the 3rd counters that move on dual listing news (previously XLX and Oceanus), and this is likely to be the trend in the near term. Other counters that have similar intentions are Midas, Map Technology, Chiangtian, which have all moved up in recent days as players hype on the "revaluation" story of such corporate actions.

Talk in the market has been that more counters are likely to seek out for such corporate actions as it seek out better valuation in market outside Singapore. In general, I continue to hold the views that such expectation is likely to force a revaluation of S-chip especially those with strong fundamental, since they are likely to be approach for such dual listing action.

Personally, among the S-chips, I favor counters such as Sinomem and Sinotel (which is already on US mkt via ADR). Both are solidly run company with strong management and business. If they can't get the right value here, I am sure they will seek it elsewhere and I am probably not the only one thinking about this.

Sinomem has been testing the 60.5 resistance in recents days, a breakout of this R will likely see it spike up to 64 and above. Immediate support at 58.

Sinotel seems to have broke recent upper trendline, but have to cross 67 for a convincing move upward. Immediate support at 63.

Such counters provide both short term (dual listing play) and long term potential (Business fundamental), hence is worth considering.

Congratulation to those who have believe in my new year rally prediction...and has piled on during the X'mas season. Must buy me lunch ok?

This blog is a selections of my investment views to my client. If you find it useful or have additional information to share, please do let me know. These blogs are my personal views and is not meant to solicit any sales or investment on any securities or investment. I may have vested interest in some of the counters or investment products, hence please invest at your own risk. As usual invest in what you understand and do your own homework as usual.

This is the 3rd counters that move on dual listing news (previously XLX and Oceanus), and this is likely to be the trend in the near term. Other counters that have similar intentions are Midas, Map Technology, Chiangtian, which have all moved up in recent days as players hype on the "revaluation" story of such corporate actions.

Talk in the market has been that more counters are likely to seek out for such corporate actions as it seek out better valuation in market outside Singapore. In general, I continue to hold the views that such expectation is likely to force a revaluation of S-chip especially those with strong fundamental, since they are likely to be approach for such dual listing action.

Personally, among the S-chips, I favor counters such as Sinomem and Sinotel (which is already on US mkt via ADR). Both are solidly run company with strong management and business. If they can't get the right value here, I am sure they will seek it elsewhere and I am probably not the only one thinking about this.

Sinomem has been testing the 60.5 resistance in recents days, a breakout of this R will likely see it spike up to 64 and above. Immediate support at 58.

Sinotel seems to have broke recent upper trendline, but have to cross 67 for a convincing move upward. Immediate support at 63.

Such counters provide both short term (dual listing play) and long term potential (Business fundamental), hence is worth considering.

Congratulation to those who have believe in my new year rally prediction...and has piled on during the X'mas season. Must buy me lunch ok?

This blog is a selections of my investment views to my client. If you find it useful or have additional information to share, please do let me know. These blogs are my personal views and is not meant to solicit any sales or investment on any securities or investment. I may have vested interest in some of the counters or investment products, hence please invest at your own risk. As usual invest in what you understand and do your own homework as usual.

Tuesday, January 5, 2010

Market Poised for a New Year Rally - The Verdict

Dow gave an encouraging performance on the 1st trading day of 2010, by climbing up 155.8pts or 1.49% to close at 10,584.

Investors were encouraged after the Institute for Supply Management showed a bigger-than-expected uptick in manufacturing activity during December, helped by improving production and ordering activity. Factory employment also showed gradual improvement. Also comforting some were Federal Reserve officials' comments from the weekend that played down the idea of lifting its easy-money policy in early 2010. Nevertheless, Chairman Ben Bernanke said the Fed needs to "remain open" to raising rates to avert or pop future asset bubbles.

Also, the Commerce Department reported U.S. construction spending tumbled in November more than expected, pulled lower by the housing and commercial sectors.

While a 100pts may not really qualify for a rally yet, but what I wish to highlight is the underlying theme that the market will be trading on in the next 2 to 3 months is precisely what we are seeing above - a mixed bag of economic signals that will keep the Fed on the defensive for the short-term.

Yes, an increase in rate in 2010 is a given and the market will on and off factor that in, the real question is now when. Some are saying 2H10 with some even saying 2Q10. My guess is incline toward the 2H, giving the US economy more time to stabilize and show real sign of an upturn.

With that in mind, note too that Crude oil cross $80 yesterday. Winter months in the northern hemisphere is perhaps 1 reason, with the USD weakening as the other. But my guess is that crude oil will only climb higher in 2010, with $100 within sight.

Well, I wish my prayer for a New Year Rally comes true.....and that all of us can make some money from the market this year!

--> Send out before mkt open this morning.

at 1517hr STI is up 20+ pt or 0.75%.

I really hope my clients have entered some trade and make some good money this start of the new year!

This blog is a selections of my investment views to my client. If you find it useful or have additional information to share, please do let me know. These blogs are my personal views and is not meant to solicit any sales or investment on any securities or investment. I may have vested interest in some of the counters or investment products, hence please invest at your own risk. As usual invest in what you understand and do your own homework as usual.

Investors were encouraged after the Institute for Supply Management showed a bigger-than-expected uptick in manufacturing activity during December, helped by improving production and ordering activity. Factory employment also showed gradual improvement. Also comforting some were Federal Reserve officials' comments from the weekend that played down the idea of lifting its easy-money policy in early 2010. Nevertheless, Chairman Ben Bernanke said the Fed needs to "remain open" to raising rates to avert or pop future asset bubbles.

Also, the Commerce Department reported U.S. construction spending tumbled in November more than expected, pulled lower by the housing and commercial sectors.

While a 100pts may not really qualify for a rally yet, but what I wish to highlight is the underlying theme that the market will be trading on in the next 2 to 3 months is precisely what we are seeing above - a mixed bag of economic signals that will keep the Fed on the defensive for the short-term.

Yes, an increase in rate in 2010 is a given and the market will on and off factor that in, the real question is now when. Some are saying 2H10 with some even saying 2Q10. My guess is incline toward the 2H, giving the US economy more time to stabilize and show real sign of an upturn.

With that in mind, note too that Crude oil cross $80 yesterday. Winter months in the northern hemisphere is perhaps 1 reason, with the USD weakening as the other. But my guess is that crude oil will only climb higher in 2010, with $100 within sight.

Well, I wish my prayer for a New Year Rally comes true.....and that all of us can make some money from the market this year!

--> Send out before mkt open this morning.

at 1517hr STI is up 20+ pt or 0.75%.

I really hope my clients have entered some trade and make some good money this start of the new year!

This blog is a selections of my investment views to my client. If you find it useful or have additional information to share, please do let me know. These blogs are my personal views and is not meant to solicit any sales or investment on any securities or investment. I may have vested interest in some of the counters or investment products, hence please invest at your own risk. As usual invest in what you understand and do your own homework as usual.

Monday, January 4, 2010

Stockwatch: Midas

DESCRIPTION OF MIDAS

Midas was listed on SGX on 23 Feb 2004 at an IPO offer price of S$0.115 1 . Midas has three main business divisions, viz. Aluminum Alloy, Polyethylene Pipe (PE) and Agency and Procurement. They are described in detail below:

A) Aluminium alloy

Aluminium has several favourable characteristics such as being highly versatile, light and a good conductor of heat and electricity. Thus, it is used in a myriad of industries. Midas’s aluminium alloy is used in the transportation industry for manufacturing products such as body frames of MRT, LRT trains etc. Aluminium alloy can also be utilised in the power industry to manufacture transmission cables and mechanical parts for industrial equipment. This manufacturing is done by its wholly owned subsidiary Jilin Midas Aluminium Industries Co., Ltd. which is located in north eastern China, close proximity to major customers such as Changchun Railway Vehicles. This division contributed about 95% to 3QFY09 revenue.

B) PE

Midas manufactures two basic types of PE Pipes – Water PE Pipes and Gas PE Pipes. For gas pipes, they are typically used by gas companies which supply flammable gas to consumers. Midas targets China’s municipal cities, for their gas transmission and water distribution infrastructure projects.

C) Agency and procurement

The agency and procurement division serves as a central procurement center for its Aluminium Alloy and PE divisions. It does the import, export and wholesale of aluminium alloy, polyethylene pipes, metal materials and other related products.

Both PE and Agency and procurement divisions currently have insignificant revenue contribution.

INVESTMENT MERITS

A) Bright industry outlook

With reference to Chart 1 , rail penetration remains low in China at 59 rail km per million of population vis-à-vis 184 rail km per million of population in Japan. Thus, it is apparent that China would continue to increase their railway lines and the number of trains servicing the lines. According to the official Xinhua agency, Yan Hexiang, a senior Ministry of Railways official reiterated on 23 Nov 09 that China will continue to have over 120,000 km of track by 2020, up from 78,000 km at the end of 2007. China has also stated in previous interviews that they would invest more than CNY700b a year in rail construction on average over the next three years after a rise to CNY600b this year. Thus, the outlook is bright for companies like Midas.

Chart 1: Various countries’ rail penetration per million of population

Source: US Central Intelligence Agency World Factbook 2008

B) One of the four licensed metro rolling stock manufacturers

Midas is one of the four licensed metro rolling stock manufacturers through its 32.5%-owned associate company Nanjing SR Puzhen Rail Transport (NRPT). Midas has an estimated 80% market share of the large section aluminium extrusion market as it supplies to all rolling stock manufacturers. Going forward, NPRT is expected to have a more significant contribution to Midas as revenue recognition accelerates with its RMB5.5b order books to be delivered from 2H09 onwards.

C) Excellent reputation for quality and management

Midas was the only company in China to be awarded the prestigious International Railway Industry Standard (IRIS) certification in Jul 2009. This is a testament of Midas’ commitment to quality products.

Midas has also been named by Forbes Asia as Forbes Asia’s Best Under A Billion Company consecutively for four years from 2006 to 2009. This reflects the excellent stewardship of Midas under its management.

D) Abundant stock catalysts

There will be abundant stock catalysts in the near and medium term. They come from the following five aspects, namely announcement of contracts awarded by China North Locomotive and Rolling Stock (CNR) and China South Locomotive and Rolling Stock (CSR); significant contribution from NPRT; more than doubling of its aluminium alloy extrusion production lines; dual listing and increasing traction from its fabrication lines.

Firstly, China’s Ministry of Railways has closed its 2nd tender for the production of 4,160 high speed train cars (double of previous tender) and contracts have been awarded to CNR and CSR in late September. Contract announcement awarded by them to Midas should be imminent within the next two months.

NPRT is expected to have a significant contribution as more train cars would be delivered in 4QFY09. According to a Kim Eng report, Midas’s profit share is estimated to be approximately $6.4m in FY09 as compared to S$1.0m contributed for 9MFY09. In my opinion, I have a more conservative estimate of around S$3.5m contribution in FY09.

Midas would be expanding its aluminium alloy extrusion production lines from the current 20,000 tonnes to 50,000 tonnes by end 2010. This would have a huge positive impact to its financial results as Midas is currently capped by its capacity.

Midas has appointed Credit Suisse in evaluating and preparing for the dual listing. Dual listing is expected to increase Midas profile and shareholder base and allows it to secure additional equity financing if necessary. Dual listing may also create a short term quick upside as speculators and punters pile into Midas (remember that China XLX soared 77% on its HK dual listing day, despite stratospheric valuations).

Midas reached another milestone in its long term strategy to be an integrated manufacturer and one-stop service supplier to the rail transportation industry by winning three fabrication contracts worth of RMB121.8m. This is likely to gain traction in 2H2010 and 2011 onwards as companies would like to see Midas track record in this segment before awarding more contracts to Midas.

INVESTMENT RISKS

A) Margins dependent on fluctuations in raw material cost to a certain extent

Midas is exposed to mainly two kinds of raw materials, viz. plastic resin for PE and aluminium alloys for its aluminium alloy division. As PE is an insignificant revenue contributor, I will focus more on aluminium alloy. According to prospectus, aluminium alloy accounted for 64% of its cost of sales in FY2002 (except for the prospectus, there is no explicit mention of aluminium alloy as a percentage of cost of sales in its other financial statements). I expect aluminium alloy to account for at least 50% of its cost of sales in FY2009 which makes it an important raw material. However, according to most metal analysts, aluminum prices are unlikely to surge due to excess inventories. Besides, Midas mitigated this problem by structuring 70% of its contracts on a back to back basis while the remaining 30% are on a cost plus basis.

B) Lumpy nature on revenue

Midas recognizes its revenue on a completed contract basis thus it will be expected that certain quarters may be better than other quarters, depending on the size of the contracts completed.

C) Excessive reliance on one aluminium alloy supplier

Yingyuan Special Aluminium Industry Co supplies more than 90% of Midas’ aluminium requirement. Midas is cognizant of this supplier risk and has expressed intention to expand into upstream aluminium billet production if its aluminium alloy requirement hits 40,000 tonnes, so as to gain economies of scale.

D) Capital intensive industry

According to OCBC research, one aluminium alloy extrusion production line costs about S$32m or RMB160m. This excludes land cost. Thus, Midas has to manage its cash flow properly between investing in value added capital expenditure and distributing as dividends to shareholders.

CONCLUSION

With reference to Table 1 below, Midas is trading in line with its peers based on FY09F PE. However, Midas is likely to have high growth in FY10 and “explosive” growth in FY11, thus I believe it would be sound to base on FY11F results. Based on 18.4x FY11F earnings, Midas’ share price works out to be about S$1.18. This represents an approximate 31% upside since its close of S$0.90 on last Fri.

Table 1: Comparison of Midas and its competitors

Source: Bloomberg

1 The IPO price was adjusted for a stock split of two for one in July 2004.

Article by: Ernest Lim is an assistant treasury and investment manager at Infocomm Development Authority of Singapore (IDA). Prior to joining IDA in 2009, he was with Legacy Capital Group Pte Ltd, a boutique asset management and private equity firm, as an investment manager since 2006. He received a Bachelor of Accountancy (Honours) from Nanyang Technological University in 2005. He is a Chartered Financial Analyst, as well as, a Certified Public Accountant Singapore.

My Take:

This counter has been on the buy list of several brokerage houses, largely on a buy call.

As mentioned by Ernest above, this counter has got fundamental and is not just another S-Chip. In fact, this counter is not really be a S-chip even thou its key business is in China as the guy who run it is actually a Singaporean...brother of Mr Chew Hua Seng (of Raffles Education).

It is worthwhile to put Midas on your radar screen, for the very fact, that it is a dual-listing play (it is going for HK Dual Listing) and that it has secured several contracts of late.

Chart wise, it is worthwhile to consider accumulating this counter around 90cents to 91 cents level with stop below 89cents. 95 is key resistance level to breach.

--> This stock watch is issued around 8.45am this morning to my client.

This blog is a selections of my investment views to my client. If you find it useful or have additional information to share, please do let me know. These blogs are my personal views and is not meant to solicit any sales or investment on any securities or investment. I may have vested interest in some of the counters or investment products, hence please invest at your own risk. As usual invest in what you understand and do your own homework as usual.

Midas was listed on SGX on 23 Feb 2004 at an IPO offer price of S$0.115 1 . Midas has three main business divisions, viz. Aluminum Alloy, Polyethylene Pipe (PE) and Agency and Procurement. They are described in detail below:

A) Aluminium alloy

Aluminium has several favourable characteristics such as being highly versatile, light and a good conductor of heat and electricity. Thus, it is used in a myriad of industries. Midas’s aluminium alloy is used in the transportation industry for manufacturing products such as body frames of MRT, LRT trains etc. Aluminium alloy can also be utilised in the power industry to manufacture transmission cables and mechanical parts for industrial equipment. This manufacturing is done by its wholly owned subsidiary Jilin Midas Aluminium Industries Co., Ltd. which is located in north eastern China, close proximity to major customers such as Changchun Railway Vehicles. This division contributed about 95% to 3QFY09 revenue.

B) PE

Midas manufactures two basic types of PE Pipes – Water PE Pipes and Gas PE Pipes. For gas pipes, they are typically used by gas companies which supply flammable gas to consumers. Midas targets China’s municipal cities, for their gas transmission and water distribution infrastructure projects.

C) Agency and procurement

The agency and procurement division serves as a central procurement center for its Aluminium Alloy and PE divisions. It does the import, export and wholesale of aluminium alloy, polyethylene pipes, metal materials and other related products.

Both PE and Agency and procurement divisions currently have insignificant revenue contribution.

INVESTMENT MERITS

A) Bright industry outlook

With reference to Chart 1 , rail penetration remains low in China at 59 rail km per million of population vis-à-vis 184 rail km per million of population in Japan. Thus, it is apparent that China would continue to increase their railway lines and the number of trains servicing the lines. According to the official Xinhua agency, Yan Hexiang, a senior Ministry of Railways official reiterated on 23 Nov 09 that China will continue to have over 120,000 km of track by 2020, up from 78,000 km at the end of 2007. China has also stated in previous interviews that they would invest more than CNY700b a year in rail construction on average over the next three years after a rise to CNY600b this year. Thus, the outlook is bright for companies like Midas.

Chart 1: Various countries’ rail penetration per million of population

Source: US Central Intelligence Agency World Factbook 2008

B) One of the four licensed metro rolling stock manufacturers

Midas is one of the four licensed metro rolling stock manufacturers through its 32.5%-owned associate company Nanjing SR Puzhen Rail Transport (NRPT). Midas has an estimated 80% market share of the large section aluminium extrusion market as it supplies to all rolling stock manufacturers. Going forward, NPRT is expected to have a more significant contribution to Midas as revenue recognition accelerates with its RMB5.5b order books to be delivered from 2H09 onwards.

C) Excellent reputation for quality and management

Midas was the only company in China to be awarded the prestigious International Railway Industry Standard (IRIS) certification in Jul 2009. This is a testament of Midas’ commitment to quality products.

Midas has also been named by Forbes Asia as Forbes Asia’s Best Under A Billion Company consecutively for four years from 2006 to 2009. This reflects the excellent stewardship of Midas under its management.

D) Abundant stock catalysts

There will be abundant stock catalysts in the near and medium term. They come from the following five aspects, namely announcement of contracts awarded by China North Locomotive and Rolling Stock (CNR) and China South Locomotive and Rolling Stock (CSR); significant contribution from NPRT; more than doubling of its aluminium alloy extrusion production lines; dual listing and increasing traction from its fabrication lines.

Firstly, China’s Ministry of Railways has closed its 2nd tender for the production of 4,160 high speed train cars (double of previous tender) and contracts have been awarded to CNR and CSR in late September. Contract announcement awarded by them to Midas should be imminent within the next two months.

NPRT is expected to have a significant contribution as more train cars would be delivered in 4QFY09. According to a Kim Eng report, Midas’s profit share is estimated to be approximately $6.4m in FY09 as compared to S$1.0m contributed for 9MFY09. In my opinion, I have a more conservative estimate of around S$3.5m contribution in FY09.

Midas would be expanding its aluminium alloy extrusion production lines from the current 20,000 tonnes to 50,000 tonnes by end 2010. This would have a huge positive impact to its financial results as Midas is currently capped by its capacity.

Midas has appointed Credit Suisse in evaluating and preparing for the dual listing. Dual listing is expected to increase Midas profile and shareholder base and allows it to secure additional equity financing if necessary. Dual listing may also create a short term quick upside as speculators and punters pile into Midas (remember that China XLX soared 77% on its HK dual listing day, despite stratospheric valuations).

Midas reached another milestone in its long term strategy to be an integrated manufacturer and one-stop service supplier to the rail transportation industry by winning three fabrication contracts worth of RMB121.8m. This is likely to gain traction in 2H2010 and 2011 onwards as companies would like to see Midas track record in this segment before awarding more contracts to Midas.

INVESTMENT RISKS

A) Margins dependent on fluctuations in raw material cost to a certain extent

Midas is exposed to mainly two kinds of raw materials, viz. plastic resin for PE and aluminium alloys for its aluminium alloy division. As PE is an insignificant revenue contributor, I will focus more on aluminium alloy. According to prospectus, aluminium alloy accounted for 64% of its cost of sales in FY2002 (except for the prospectus, there is no explicit mention of aluminium alloy as a percentage of cost of sales in its other financial statements). I expect aluminium alloy to account for at least 50% of its cost of sales in FY2009 which makes it an important raw material. However, according to most metal analysts, aluminum prices are unlikely to surge due to excess inventories. Besides, Midas mitigated this problem by structuring 70% of its contracts on a back to back basis while the remaining 30% are on a cost plus basis.

B) Lumpy nature on revenue

Midas recognizes its revenue on a completed contract basis thus it will be expected that certain quarters may be better than other quarters, depending on the size of the contracts completed.

C) Excessive reliance on one aluminium alloy supplier

Yingyuan Special Aluminium Industry Co supplies more than 90% of Midas’ aluminium requirement. Midas is cognizant of this supplier risk and has expressed intention to expand into upstream aluminium billet production if its aluminium alloy requirement hits 40,000 tonnes, so as to gain economies of scale.

D) Capital intensive industry

According to OCBC research, one aluminium alloy extrusion production line costs about S$32m or RMB160m. This excludes land cost. Thus, Midas has to manage its cash flow properly between investing in value added capital expenditure and distributing as dividends to shareholders.

CONCLUSION

With reference to Table 1 below, Midas is trading in line with its peers based on FY09F PE. However, Midas is likely to have high growth in FY10 and “explosive” growth in FY11, thus I believe it would be sound to base on FY11F results. Based on 18.4x FY11F earnings, Midas’ share price works out to be about S$1.18. This represents an approximate 31% upside since its close of S$0.90 on last Fri.

Table 1: Comparison of Midas and its competitors

Source: Bloomberg

1 The IPO price was adjusted for a stock split of two for one in July 2004.

Article by: Ernest Lim is an assistant treasury and investment manager at Infocomm Development Authority of Singapore (IDA). Prior to joining IDA in 2009, he was with Legacy Capital Group Pte Ltd, a boutique asset management and private equity firm, as an investment manager since 2006. He received a Bachelor of Accountancy (Honours) from Nanyang Technological University in 2005. He is a Chartered Financial Analyst, as well as, a Certified Public Accountant Singapore.

My Take:

This counter has been on the buy list of several brokerage houses, largely on a buy call.

As mentioned by Ernest above, this counter has got fundamental and is not just another S-Chip. In fact, this counter is not really be a S-chip even thou its key business is in China as the guy who run it is actually a Singaporean...brother of Mr Chew Hua Seng (of Raffles Education).

It is worthwhile to put Midas on your radar screen, for the very fact, that it is a dual-listing play (it is going for HK Dual Listing) and that it has secured several contracts of late.

Chart wise, it is worthwhile to consider accumulating this counter around 90cents to 91 cents level with stop below 89cents. 95 is key resistance level to breach.

--> This stock watch is issued around 8.45am this morning to my client.

This blog is a selections of my investment views to my client. If you find it useful or have additional information to share, please do let me know. These blogs are my personal views and is not meant to solicit any sales or investment on any securities or investment. I may have vested interest in some of the counters or investment products, hence please invest at your own risk. As usual invest in what you understand and do your own homework as usual.

In the Grapevine: Transview - May run due to its stake in Trafford resource.

Trafford Resources Limited is a Perth-based mineral exploration company which has been listed on the Australian Stock Exchange since Mid June, 2006.

Trafford’s primary focus is exploring for Iron Oxide, Copper, Gold and Uranium (IOCGU) deposits at the Wilcherry Hill Project in South Australia’s Gawler Craton. Trafford recently discovered large quantities of high grade magnetite iron and is currently investigating the feasibility of establishing iron ore operations at Wilcherry. Gold associated with some of the iron could be a major beneficial by-product.

Transview Holdings says wholly-owned subsidiary Transview Resources has signed a share placement agreement with Trafford Resources to purchase 6,203,486 new shares representing 10% of the share capital of Trafford at A$0.25 per share or a total of A$1,550,871.50 ($1,954,098).

Transview Resources also has the option to acquire a further 5% (3,101,514) of new Trafford shares at A$0.25 per share. Upon exercise of the options, Transview Resources will own 9,305,000 ordinary shares in Trafford, which represents 15% of Trafford’s current share capital. The investment is funded by the group’s internal resources.

Trafford last traded at A$0.89 and has been shooting up sharply lately since it announced the discovery of gold.

Head in the grapevine: Transview is being accumulated.

Do note: Transview liquidity has not been fantastic, so there is liquidity risk.

--> This note is send out around 9.30am this morning.. Transview has since move up to closed at 19cents today.

This blog is a selections of my investment views to my client. If you find it useful or have additional information to share, please do let me know. These blogs are my personal views and is not meant to solicit any sales or investment on any securities or investment. I may have vested interest in some of the counters or investment products, hence please invest at your own risk. As usual invest in what you understand and do your own homework as usual.

Subscribe to:

Comments (Atom)